Re: падение цен на недвижимость - ага - щазз

Добавлено: 05 апр 2020, 12:15

Если цены на недвигу будут расти медленнее ифляции, то эффективно, они будут снижаться...

Если цены на недвигу будут расти медленнее ифляции, то эффективно, они будут снижаться...

Во время великой депрессии, в Штатах, золото запретили и у населения отняли, девальвировав доллар почти в два раза.

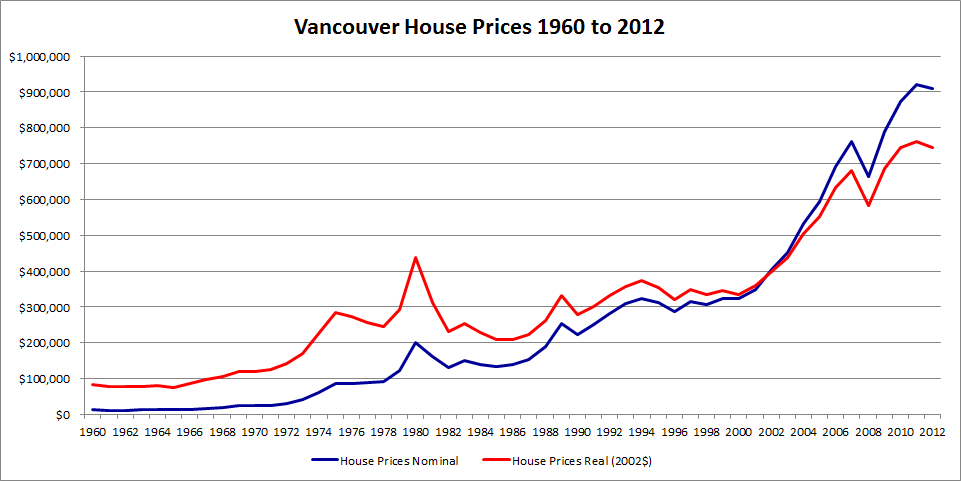

С 1981 по 1986г официальная инфляция в Канаде была 37% (6.5% в год).

Миди, это было не падение, а коррекция. Т.е. перед снижением цен был очень резкий рост.Meadie2 писал(а): ↑05 апр 2020, 12:39С 1981 по 1986г официальная инфляция в Канаде была 37% (6.5% в год).

Цены на недвижимость в Ванкувере упали приблизительно на 30%.

Т.е. реальная цена недвижимости (с учетом инфляции) упала в 2 раза.

[imghttps://vreaa.files.wordpress.com/2013/01/van_house_price_1960_2012.png[/img]

Курс канадского доллара за это время упал приблизительно с 0.85 до 0.70 USD. Т.е. в американских долларах падение стоимости ванкуверской недвижимости за 5 лет было еще большим - порядка 60%.

Тут в соседней теме вроде сравнивают с ценой за 2010 год?

Золото не классическое коммодити. Для индустрии, кроме ювелирной, бесполезно. В принципе, дорогим или дешёвым быть не может. А вот валюта, в которой оно измеряется, может.

Insurance shock for B.C. condo owners

...Pauls said covering the hike will require a one-time levy of $3,000 per unit, as well as doubling the monthly strata free to $600.

Langley realtor Corbin Chivers called the rise in premiums a “strata insurance crisis” that will drastically change the future of condo and apartment real estate in the Lower Mainland and Vancouver.

Chivers who is with Stonehaus Realty, predicted rising insurance premiums could drive up strata fees by 20 percent or more, which is creating uncertainty that could discourage buyers.

https://www.northdeltareporter.com/news ... do-owners/

"Seems it is not a good time to own a townhouse. $6600 per year additional fees for insurance that doesn’t cover much. Legally required for all stratas no matter what the insurance company charges. That really sucks for townhouse owners. This on top of prices already falling 20% in a month and forecast to go lower."

Vancouver residential real estate has become a “riskier” asset, leading banks to raise interest rates and reduce access to money despite the Bank of Canada’s decision to cut its overnight rate, says UBC professor Tsur Somerville.

Somerville said he was not surprised that the spread between real estate mortgage interest rates and the Bank of Canada rate had grown.

“Real estate is now perceived as riskier (for banks) than it was three months ago because there’s a realization you could have people stop making mortgage payments or rent payments en masse. Normally in a downturn that evolves slowly,” he said.

On March 27, the Bank of Canada slashed its overnight interest rate to 0.25 per cent to help stem the COVID-19 financial crisis that has seen more than 2.1 million Canadians file for Employment Insurance in the past two weeks and half-a-million ask for mortgage payment deferrals.

Traditionally, a drop in the Bank of Canada overnight interest rate leads to a drop in mortgage rates. But Somerville — director of the UBC Centre for Urban Economics and Real Estate — said the current crisis was highly unusual.

“In the (2008) financial crisis there were different sorts of uncertainties around. They were economic, so you could understand a bit about what the phenomenon was. But with this it’s not the economy grinding down slowly, it’s not a financial panic, it’s not an economic shock. It’s a public health shock. That’s very, very different and we don’t how it will be on the other side,” he said.

For example, it was impossible to predict how trade and tourism — two mainstays of the provincial economy — would respond once social distancing restrictions were relaxed or lifted.

“With trade, do we get de-globalization? With tourism, do we get people living for the moment now and being tourists or do people get fearful?” Somerville asked, while pointing out that all the debt governments are taking on to support the economy will have to be repaid.

“Governments are rightly loading up on debt to get us through. But on the other side you have to pay off that debt. But what if we have a five per cent tax to repay the debt? Well, that slows the economy. We have so much uncertainty that it’s very hard to think about where things might be once we have more certainty. How we relate to each other is going to be different.”

Vancouver realtor and commentator Steve Saretsky said it would take at least a year before heavy discounts in residential prices appeared, because real estate was not a liquid asset. He said it also takes 18-months for default properties to be sold.

However, he warned that price drops were coming, for a number of reasons.

Firstly, the economy would be fundamentally changed due to unemployment and weak economic growth due to coronavirus restrictions.

“The reason real estate has been so good over the past five years is that we have had low unemployment, a relatively strong economy and low interest rates. That allowed everybody to get a mortgage and leverage up and that pushed prices higher,” Saretsky said. “Now we are in a situation where the economy is going to be really weak, unemployment is going to be high and banks are going to be tight.”

The second reason was tightness in the money market.

“Over the next week or two the banks are going to tighten,” he said. “Even if you want a mortgage they might not give you one. As a bank you can’t blame them.”

And third, Saretsky said that coming into the coronavirus crisis “consumer insolvencies were growing at a pretty rapid pace, the quickest in 10 years and that was when the economy was buzzing and we had the lowest unemployment in 10 years.

“Now unemployment is up to 15 per cent, consumer insolvencies are going to go up. Everyone thinks prices will be down 10 per cent by May. It’s a much more drawn out process because real estate is so illiquid. There’s no price discovery right now because nothing is selling.”

According to the latest Real Estate Board of Greater Vancouver figures, last month there were 2,524 sales across all classes of residential homes. This was an increase over the same time last year, that included a 2.1 per cent increase in values.

However, the board noted that everything changed mid way through March, when the state of emergency was called. Realtors are considered an essential service.

В этом анализе не упомянуты два очень важных момента, которые могут очень негативно повлиять на ситуацию на рынке:Marmot писал(а): ↑05 апр 2020, 21:01 https://vancouversun.com/news/covid-19- ... 4046fee5b/

... Vancouver realtor and commentator Steve Saretsky said it would take at least a year before heavy discounts in residential prices appeared, because real estate was not a liquid asset. He said it also takes 18-months for default properties to be sold.

However, he warned that price drops were coming, for a number of reasons. ...