по крайней мере его невозможно напечатать

Краткосрочная перспектива - 2

Правила форума

Пожалуйста, ознакомьтесь с правилами данного форума

Пожалуйста, ознакомьтесь с правилами данного форума

-

Robots

- Маньяк

- Сообщения: 3194

- Зарегистрирован: 01 июн 2007, 02:16

- 3ABXO3

- Графоман

- Сообщения: 13509

- Зарегистрирован: 10 сен 2012, 18:07

- Откуда: Qikiqtarjuaq

Re: Краткосрочная перспектива - 2

А тем временем Shopify стал крупнейшей компанией на TSX.

- simon

- Графоман

- Сообщения: 14671

- Зарегистрирован: 29 июл 2006, 09:31

Re: Краткосрочная перспектива - 2

На новости US unemployment claims hit 33.3 million amid virus ам. индексы сегодня растут

- 3ABXO3

- Графоман

- Сообщения: 13509

- Зарегистрирован: 10 сен 2012, 18:07

- Откуда: Qikiqtarjuaq

Re: Краткосрочная перспектива - 2

#унасралли (ц) aкела

- 3ABXO3

- Графоман

- Сообщения: 13509

- Зарегистрирован: 10 сен 2012, 18:07

- Откуда: Qikiqtarjuaq

Re: Краткосрочная перспектива - 2

Всё примерно так:simon писал(а): ↑07 май 2020, 09:42 На новости US unemployment claims hit 33.3 million amid virus ам. индексы сегодня растут

-

turtle

- Графоман

- Сообщения: 5912

- Зарегистрирован: 05 фев 2007, 19:05

-

Robots

- Маньяк

- Сообщения: 3194

- Зарегистрирован: 01 июн 2007, 02:16

Re: Краткосрочная перспектива - 2

никто уже на экономику не обращает внимания, следят печатают ли деньги. Если печатают, то все пойдет вверх, а нет - вниз, потому как, на долговой карточный домик, который по инерции называют экономикой, нынешний сток маркет уже давно перестал опираться.3ABXO3 писал(а): ↑09 май 2020, 17:54Всё примерно так:simon писал(а): ↑07 май 2020, 09:42 На новости US unemployment claims hit 33.3 million amid virus ам. индексы сегодня растут

-

Vovchik

- Маньяк

- Сообщения: 2883

- Зарегистрирован: 20 фев 2003, 09:15

- Откуда: Vancouver

Re: Краткосрочная перспектива - 2

SPX - 340 и на 25 лет? Золото тоже дешевело. Тогда правда был золотой стандард.

-

turtle

- Графоман

- Сообщения: 5912

- Зарегистрирован: 05 фев 2007, 19:05

Re: Краткосрочная перспектива - 2

Да, но чувак всё правильно рассказывает, как это будет в реальной жизни время покажет и как это затронет Канаду?

-

Vovchik

- Маньяк

- Сообщения: 2883

- Зарегистрирован: 20 фев 2003, 09:15

- Откуда: Vancouver

Re: Краткосрочная перспектива - 2

Есть два существеннных отличия - отсутствие золотого стандарда и финансовые власти сработали четко. Через какое то время все поди перерастет в стагфляцию.

- george

- Графоман

- Сообщения: 14127

- Зарегистрирован: 20 июл 2003, 12:48

- Откуда: M2R

Re: Краткосрочная перспектива - 2

Интересный текст.

Another Leg Lower Is Coming, But What Happens In 2021 Will Leave Traders Speechless

by Tyler Durden

Mon, 05/11/2020 - 07:44

In a recent report by Nordea's Andreas Steno Larsen, the FX strategist looks at the recent surge in stocks and rhetorically asks "Happy days, right?", to which his response is that he is not so sure, because "is it really feasible to CTRL+P profits?" (for those confused, since reality is now more absurd than the Onion, the answer is no).

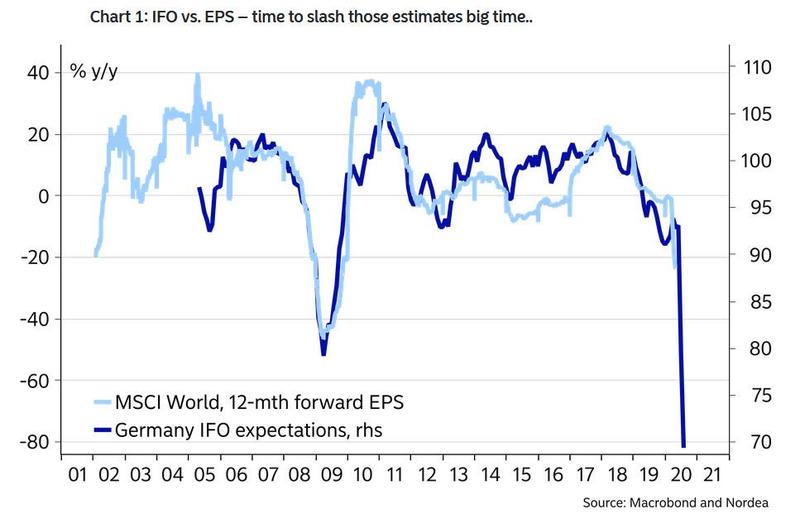

Larsen then looks at the by now infamous chart of collapsing earnings and warns that "EPS may need to be revised down at least 40-50% YoY in a quarter from now, but it seems like most equity analysts have been sipping directly from the magic central bank spring (Certainly less strong than what Elon Musk had the other day) as they look for a “mere” -20% EPS growth this year." To Larsen this is "historically naïve, sorry, optimistic."

Why? Because If expected earnings are slashed in the way that Nordea finds expects, forward P/E’s will either have to find bizarre new all-time-highs (as 2020 is deemed an outlier) or else equities will have to give in again. (Larson laconically notes that he "leans towards the latter")

- george

- Графоман

- Сообщения: 14127

- Зарегистрирован: 20 июл 2003, 12:48

- Откуда: M2R

Re: Краткосрочная перспектива - 2

https://www.zerohedge.com/markets/anoth ... speechlessgeorge писал(а): ↑11 май 2020, 17:55 Интересный текст.

Another Leg Lower Is Coming, But What Happens In 2021 Will Leave Traders Speechless

by Tyler Durden

Mon, 05/11/2020 - 07:44

In a recent report by Nordea's Andreas Steno Larsen, the FX strategist looks at the recent surge in stocks and rhetorically asks "Happy days, right?", to which his response is that he is not so sure, because "is it really feasible to CTRL+P profits?" (for those confused, since reality is now more absurd than the Onion, the answer is no).

Larsen then looks at the by now infamous chart of collapsing earnings and warns that "EPS may need to be revised down at least 40-50% YoY in a quarter from now, but it seems like most equity analysts have been sipping directly from the magic central bank spring (Certainly less strong than what Elon Musk had the other day) as they look for a “mere” -20% EPS growth this year." To Larsen this is "historically naïve, sorry, optimistic."

Why? Because If expected earnings are slashed in the way that Nordea finds expects, forward P/E’s will either have to find bizarre new all-time-highs (as 2020 is deemed an outlier) or else equities will have to give in again. (Larson laconically notes that he "leans towards the latter")

- 3ABXO3

- Графоман

- Сообщения: 13509

- Зарегистрирован: 10 сен 2012, 18:07

- Откуда: Qikiqtarjuaq

Re: Краткосрочная перспектива - 2

Zero Hedge это какая-то клоака конспираси теорий и всёпрольщества.

Zero Hedge is a batshit insane Austrian school finance blog run by two pseudonymous founders who post articles under the name "Tyler Durden," after the character from Fight Club. It's essentially apocalypse porn. It has accurately predicted 200 of the last 2 recessions.

-

Vovchik

- Маньяк

- Сообщения: 2883

- Зарегистрирован: 20 фев 2003, 09:15

- Откуда: Vancouver

- 3ABXO3

- Графоман

- Сообщения: 13509

- Зарегистрирован: 10 сен 2012, 18:07

- Откуда: Qikiqtarjuaq